Josh Cornes, market analyst at Solar Media, looks at the current status of onshore wind planning applications in the UK and discusses how the landscape for onshore wind generation could change in the coming years.

After almost a decade of being in limbo, the UK’s onshore wind sector has finally been liberated by virtue of the country’s Labour Party assuming power from the Conservative Party and coming good on its promise to end a decade-long impasse at the local council decision-making level.

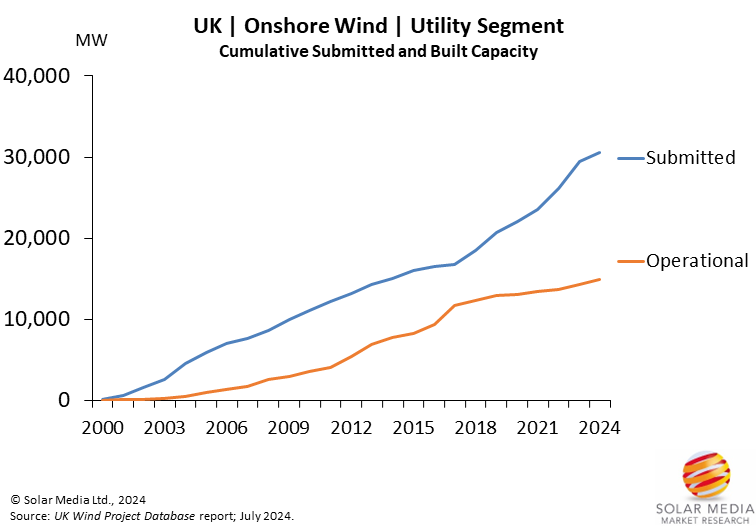

The construction of new onshore wind farms in the UK during the past five years has been at very low levels. With uncertainty in the market, during this period, the cumulative new onshore capacity barely added to that seen during 2017 alone.

Despite this apparent negativity in the market, new onshore wind applications submitted into planning paints a different picture, with the cumulative capacity in planning rising at levels not seen before. This was likely in anticipation of the Labour Party getting into power, offering a fresh perspective on how large-scale wind and solar farms are viewed across government departments as a whole.

Another positive relates to the results of the 2023 Contracts for Difference (CfD) Allocation Round 5 (AR5); this suggests that 24 onshore wind farms will be completed by 2028, with a total capacity of 1.5GW. These are all located in Scotland, with the exception of a 35MW farm in Wales. 300MW of the overall capacity is currently under construction.

The previous CfD AR4 awarded contracts at almost 1.5GW across 16 sites, with nearly 300MW completed in 2024 and a further 500MW now under construction.

Figure 1: During the past five years, over 30GW of capacity has been submitted in the UK for onshore wind farms, with about 40% of this coming online into operation.

Looking at Figure 1 above, between 2000 and 2017, submitted and operational capacity for onshore wind farms were generally in synch. Between 2014 and 2017, submitted capacity levels largely went into decline, having a knock-on effect on what was subsequently built out. Since 2017, the capacity of submitted applications has picked up; during 2018 alone, levels were more than 1.5GW, with 2023 soaring above 3GW.

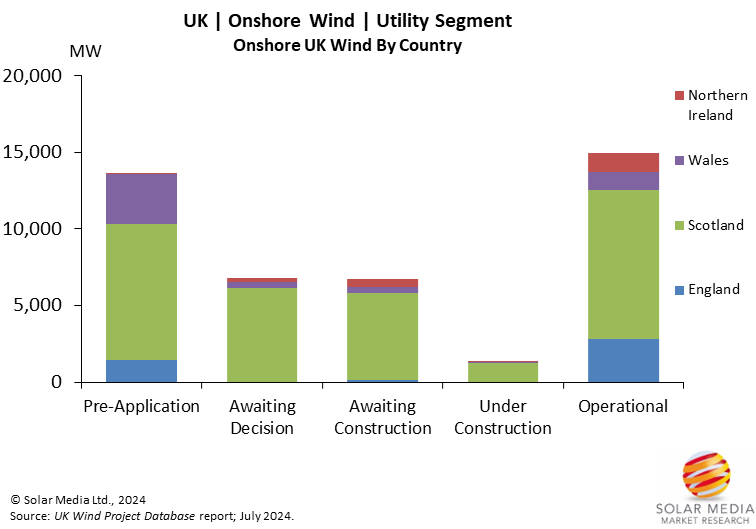

In terms of capacity by country, Scotland accounts for the largest portion, with over 6GW currently awaiting a planning decision, and a similar amount approved but awaiting construction.

Although England has about 3GW of capacity currently in operation, the pipeline is at a very low level, with just 150 MW approved, and even less having been submitted (and awaiting a planning decision). This comes as no surprise given the likelihood of rejection under the previous planning guidelines issued by the Conservative Party. However, there is a strong pipeline evolving at the ‘pre-application’ stage, mainly in the Transmission Entry Capacity (TEC) Register).

The situation in Wales looks similar to England. Although there is slightly more at the planning stage, the main difference is at the pre-application stage. The progress of some of these projects was temporarily halted, but they have started to come back online now.

Figure 2: Scotland dominates onshore wind energy production in the UK today, with the pipeline of capacity still heavily weighted to this country. New planning applications in England and Wales are expected to see a strong uptick going forward due to the recent changes to planning regulations.

One of the most exciting new developments in Scotland this year is the Viking Wind Farm in Shetland, a 443MW project, where 220 MW was awarded a CfD in the AR4, and the remainder receiving a CfD in AR5. Alongside a host of other sites also under construction now, it is possible that as much as 0.8-1GW of new wind farm capacity could be added this year, the highest annual deployment seen since 2017.

The long-term outlook for wind – both onshore and offshore – in the UK now appears firmly back on track, with the Labour Party’s promise to remove the planning restrictions imposed by the Conservative Party in England and Wales playing a key part in this. While Scotland has remained somewhat immune to these changes, the massive vote of confidence now being voiced by the Labour Party – both for onshore wind and solar farms – could well see an unprecedented uptick in new planning applications across England in the coming months.

All wind farms in the UK are tracked in detail by the Solar Media market research team, with the analysis and graphics shown above taken from the UK Wind Projects Database report, released monthly and containing a full audit trail of planned and completed solar farms in the UK. To learn more about how to access this report, please click here.