Josh Cornes summarises onshore and offshore wind developments through 2024 and so far into 2025, with offshore wind the dominating technology in the mix.

A total 15GW of wind capacity was submitted for planning during 2024, the highest in UK history, largely driven by offshore applications.

Onshore saw similar levels to 2021 and 2022 but finished the year below the levels seen in 2023.

Six offshore projects over 1GW including Ossian Offshore Wind Farm and Mona & Morgan Offshore Wind Farms were some of the highlights of the year. Although developers took a cautious approach to onshore wind in England, seven of the nine largest offshore projects are off the coast of England and are currently going through the nationally significant infrastructure project (NSIP) process.

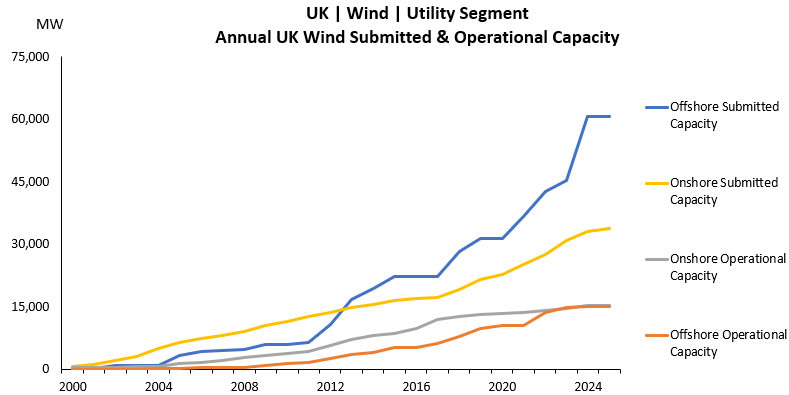

Figure 1: Onshore wind continues to see stable levels of applications, whilst offshore wind soars to new heights.

Figure 1 highlights the steep rise in offshore applications, with 2024 hitting 15GW, dwarfing the 2.5GW in 2023. With 2.1GW of onshore submitted in 2024, similar levels to 2021 and 2022, there was a slight downturn when comparing to 2023.

With the UK now having over 30GW of operational wind capacity, we can see an even split between offshore and onshore, both being just over 15GW. This balance however is expected to change soon, with Neart na Gaoithe and Moray West Phase 2 expected to be completed soon. These 450MW and 600MW projects are just part of the 10GW of offshore wind that’s currently under construction, compared to the 1.3GW of onshore projects.

Contracts for difference (CfD) Allocation Round 6 was positive for wind with nearly 5GW receiving a contract, 3.8GW being offshore.

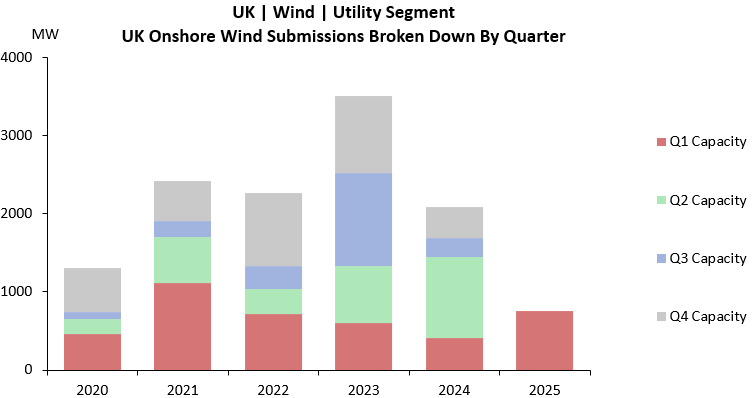

Figure 2: A breakdown of onshore wind applications per quarter since 2021, with 2024 seeing a dip in performance.

The biggest disappointment for 2024 was the second half of the year. With Q2 having over 1GW of capacity submitted, Q3 and Q4 only saw 650MW combined, leading to a 40% decrease YoY.

Figure 2 outlines the strong start 2025 has got off to, with almost 800MW already submitted into the UK planning system, the second best Q1 after 2021 and the sixth best quarter ever. The largest submission so far is Clune Wind Farm, at 280MW, making up around a third of the capacity this year. There has also been almost 600MW approved this year, making it the second best Q1 since the UK began deploying wind.

Scotland continues to lead the way in onshore wind, with seven projects being submitted into the Scottish government’s planning system this year, and 85% of 2024’s capacity being in Scotland. Wales comes next with almost 700MW of applications in the last three years. Of particular significance for Wales is the capacity at pre-application stage with 1.4GW of projects that could hit the planning system within the next 18 months.

After the lifting of the de facto ban on onshore wind in England in July 2024, the country continues to be a slow market, with the repowering of old projects the only applications seen. Scout Moor Wind Farm II did hit headlines, however, as the first scoped project in almost 10 years, hopefully paving the way for more in the future.

Offshore wind therefore leads the charge. Although onshore saw an unexpected downturn after the Labour Government took power, the start of 2025 has been incredibly positive as developers look to take advantage of the grid overhaul.

All the data above is taken from Solar Media Market Research’s analysis, which can be accessed here.

To book a demo and access the data please email [email protected].