To date, the UK has installed more than 14GW of onshore wind energy and has a pipeline of planned projects totaling 23GW.

During the second quarter of 2023, there was the highest quarterly capacity submitted into planning so far, suggesting significant future growth of wind developments.

This article examines these projects by analysing their current status, sizes, and locations. This provides a fascinating insight into how onshore wind deployment may evolve going forward, in particular if planning guidelines and government policy is – as widely expected – revised to reboot this sector.

Installed onshore wind projects in the UK

Not unexpectedly, onshore wind capacity growth in the UK has experienced a significant slowdown in recent years, with a considerable drop in yearly installations – despite impressive achievements in previous years, specifically in 2017, when incentives were still in place and fewer obstacles were present for developers and planners.

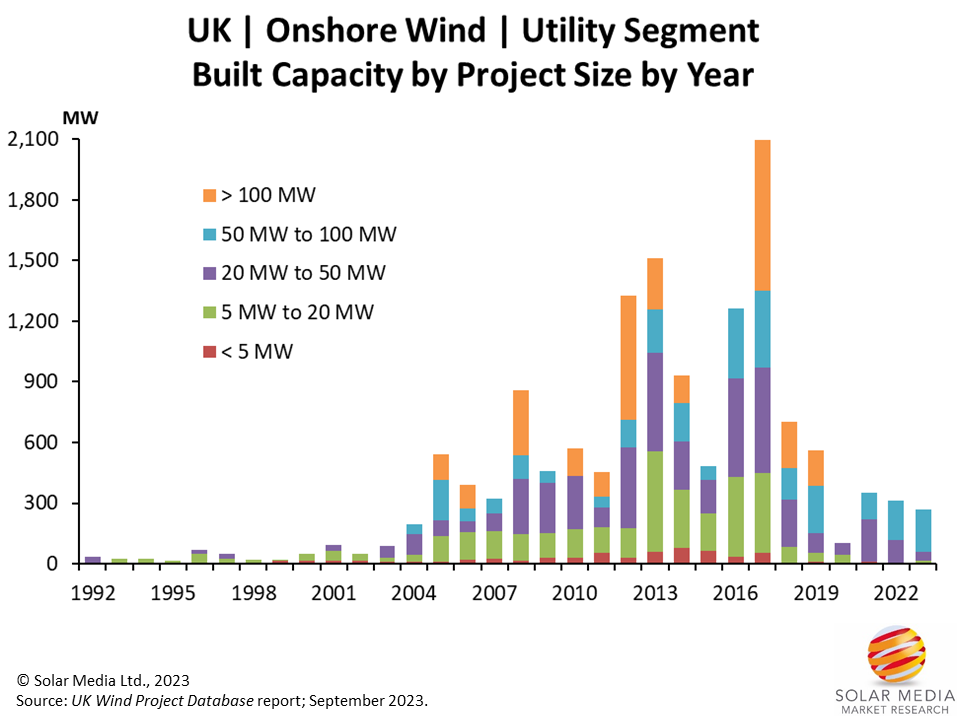

The graphic below now shows the annual deployment rates of utility-scale, onshore wind capacity.

UK onshore wind energy deployment had the highest yearly installed capacity in 2017 at 2.1GW, across 84 sites and involving the construction of 812 turbines.

This graphic shows installed capacity of onshore wind developments in the UK by project size by year, with 2017 having the highest yearly installed capacity at 2.1 GW across 84 sites.

In 2004, the market for onshore wind energy began to grow meaningfully, with installation of nearly 200MW. This was due in part to improvements in turbine technology, which allowed for larger wind farms.

The first major project to take advantage of these advances was phase 1 of the Crystal Rig I site, a 50MW wind farm installed by Fred Olsen Renewables in 2004. The following year, Scottish Power Renewables built the first large-scale onshore wind farm with a capacity in excess of 100MW, the 124MW Black Law Wind Farm.

Before 2004, almost all installed wind projects were under 20MW and none exceeded 50MW. However, since then, every year has seen at least one wind farm larger than 50MW installed and most years have seen at least one larger than 100MW installed.

The largest project installed so far is the 349.6MW Clyde Wind Farm, developed by SSE Renewables and completed in 2012.

It is noteworthy that there is a wide range of project sizes within the industry. Currently, the average project size measures at 18.6MW.

Despite the progress made in turbine technologies, the average project size is not necessarily getting bigger. This is because developers tend to opt for fewer turbines that are larger and more powerful.

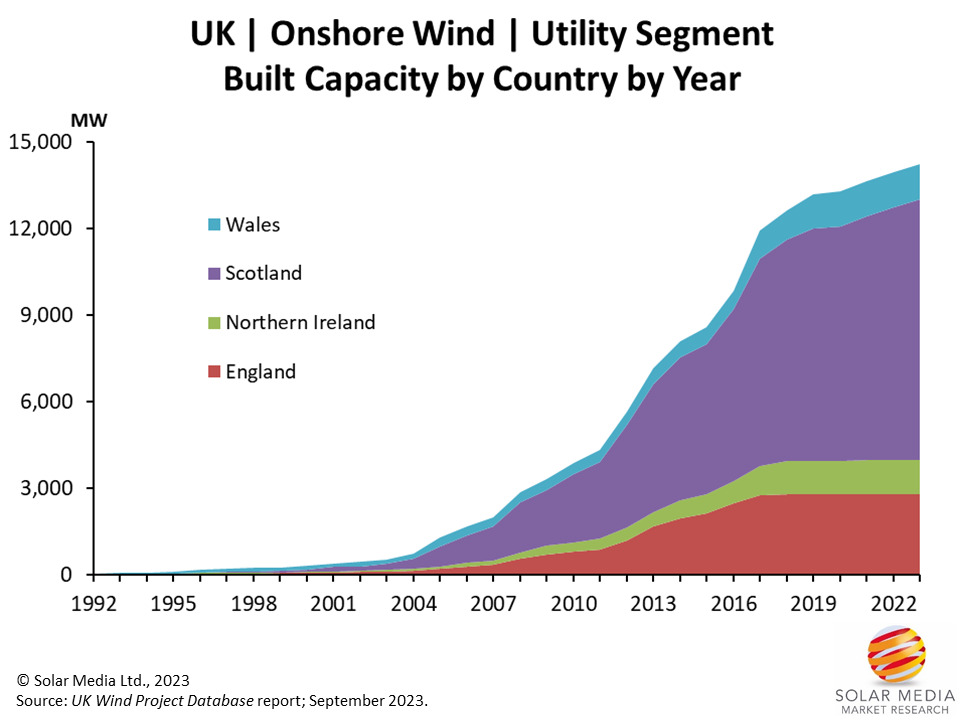

The graphic above displays the total installed capacity by country and year.

Scotland stands out as the leader with 9GW, accounting for 63% of the UK market. It’s worth noting that since 2019, the majority of newly installed projects have taken place in Scotland.

To date, Northern Ireland has 82 sites with 586 turbines, amounting to an installed capacity of 1.2GW. Wales, on the other hand, has 72 sites with 842 turbines, also with an installed capacity of 1.2GW. England has a total of 2.8GW across 274 sites with 1501 turbines, while Scotland has the highest installed capacity of 9GW across 339 sites with 4097 turbines.

Scotland is expected to account for a growing share of UK wind generation capacity, with over 90% of planned pipeline capacity located in Scotland.

Also note that in the above two graphs, the year 2023 shows year-to-date figures and final numbers for this year are certain to increase by the end of the year.

The pipeline of onshore wind projects

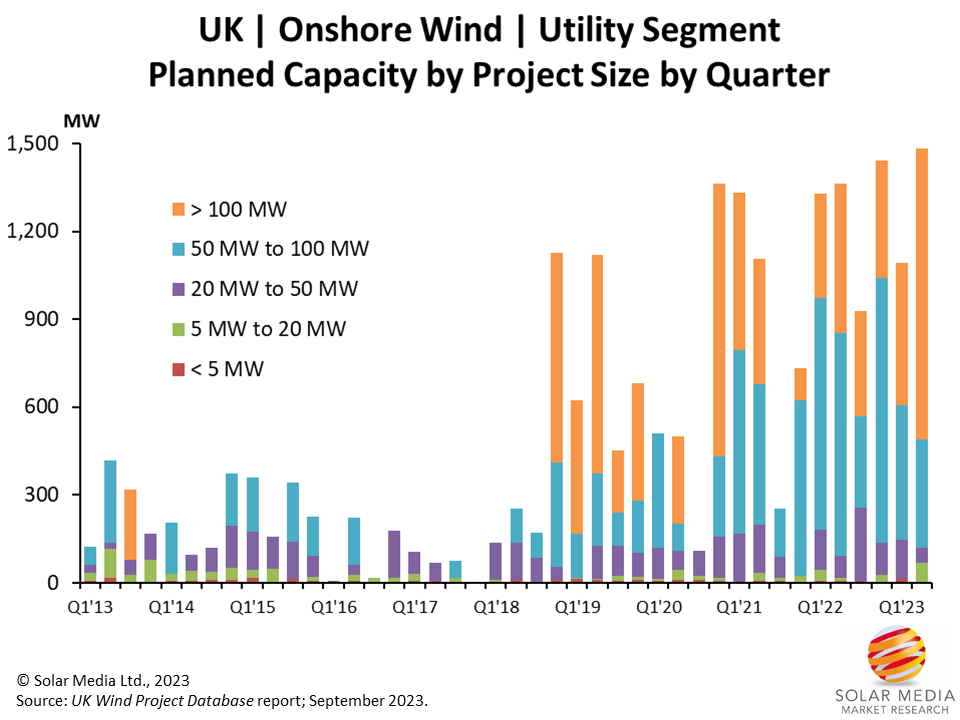

While there is a wide range of project sizes for installed wind farms, the pipeline indicates an increase in larger projects to be deployed in the future.

The following graphic displays projects going into the different planning portals across the UK, including pre-application (screening/scoping) and full application, with the bar chart segmented by project size and quarter.

In previous years, there was a more even distribution of project sizes. However, since 2019, projects exceeding 50MW have taken up a significant percentage of the submitted capacity.

Out of the total installed wind farm capacity, 41% comes from projects larger than 50MW. However, the pipeline indicates that 82% of the planned capacity is coming from projects larger than 50MW, indicating a rise in installed average wind farm capacity.

In Q2 2023, a record-breaking amount of capacity of 1.5GW across just 18 sites was submitted into planning, again suggesting a significant increase in onshore wind going forward.

The largest project currently in planning is the 525 MW Scoop Hill Community Wind Farm which is being developed by Community Windpower and was submitted during Q4 2020.

The average timeline for large-scale wind farm completion from being submitted into planning is around five years. Thus, we should expect 2019 project submissions to be constructed in the near future, assuming the political and environmental factors are conducive to full build-out.

The Status of Onshore and Offshore Wind Developments

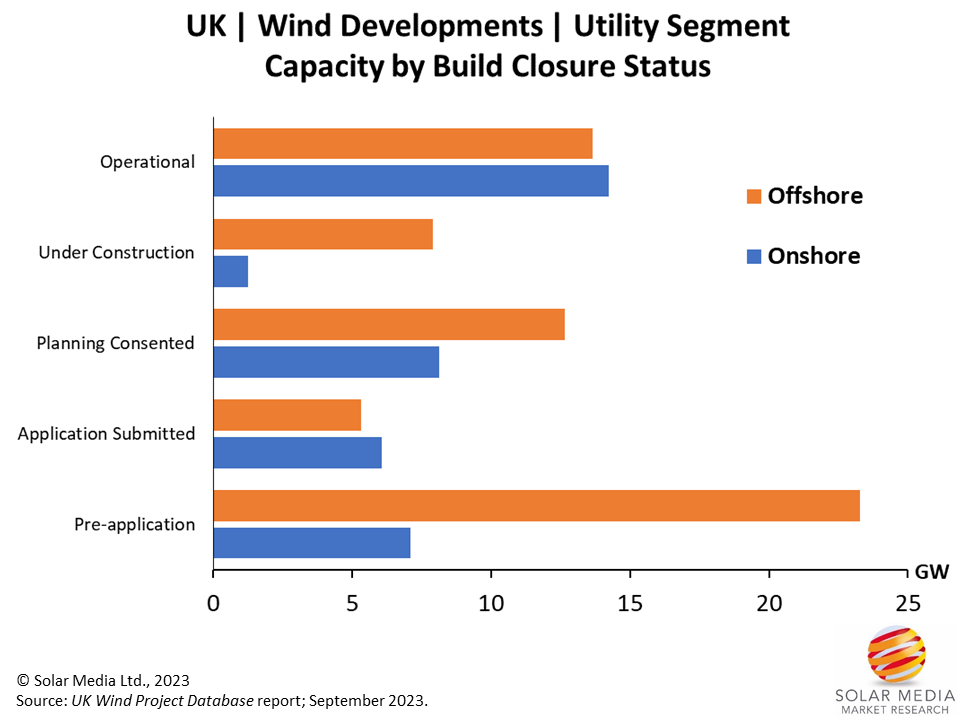

The graphic below shows the current status of onshore and offshore wind developments. The total installed capacity is over 28GW, where the installed offshore wind capacity is slightly less than the installed onshore wind capacity.

Currently, there are many offshore wind farms under construction, totaling 7.9GW, while only 1.3GW of onshore wind capacity is in the construction phase, meaning installed offshore wind capacity is likely to take over onshore wind capacity very soon.

At present, focusing on onshore wind, 84 sites are in the pre-application stage, and it is anticipated that they will submit a full application for a total of 7.1GW in the coming years. Additionally, there are 95 sites with 6.1GW currently in planning and awaiting approval, which is expected to be determined within a year. Lastly, planning permission has been granted for 8.1GW across 332 sites, and construction is likely to commence within the next few years.

To sum up, it’s highly probable that onshore wind projects will see a surge in the coming years, with potentially the forthcoming general election in the UK being the catalyst for major construction to begin.

There’s a promising pipeline of 23GW of projects in the works, with 9.4GW already under construction or scheduled to begin soon. It’s fair to say there has been a slow increase in onshore wind installations in recent years, pointing to a potential surge in the future.

All data and analysis shown in this article comes from our in-house market research at Solar Media Ltd. Full details on how to subscribe to our UK Wind Projects Database can be found here.