Cornwall Insight’s final Q4 Default Tariff Cap prediction sees a £251 drop from the current cap.

Following the closure of the observation window on 17 August, Cornwall Insight set its final prediction for the October to December 2023 price cap at £1,823, down from the current £2,074 cap.

This is also a £48 decrease from the market research company’s revised prediction following Ofgem reducing the Typical Domestic Consumption Values (TBVCs) from October.

The prediction was lowered due to Ofgem recently revising its definition of an average household’s gas and electricity usage – known as Typical Domestic Consumption Values (TDCVs) – by 7% for electricity and 4% for gas to reflect decreased consumption.

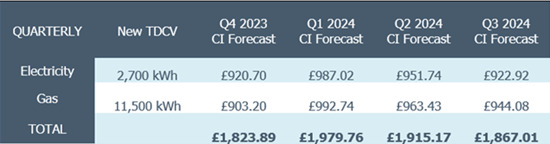

Figure 1: Cornwall Insight’s Default Tariff cap forecasts using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

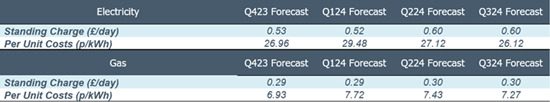

Figure 2: Default Tariff Cap forecasts using new TDCVs, Per Unit Cost and Standing Charge including VAT (dual fuel, direct debit customer, national average figures)

Although continuing to decrease, the latest price cap prediction still shows no sign of returning to pre-crises levels.

“While a small decrease in October’s bills is to be welcomed, we once again see energy price forecasts far above pre-crisis levels, underscoring the limitations of the price cap as a tool for supporting households with their energy bills. As many, including energy regulator Ofgem have acknowledged, it is essential that the government explore alternative solutions, such as social tariffs, to ensure stability and affordability for consumers,” said Dr Craig Lowrey, principal consultant at Cornwall Insight.

“This slow reduction in bills, coupled with the volatility associated with the price cap, has seen many consumers taking advantage of the return of fixed price tariffs. Such an option is a two-sided coin, while many find comfort in locking in energy prices after the turbulent bills of the past couple of years, the potential for the price cap to dip below fixed rates is also worthy of consideration. With so many unknowns in the energy market, each household must decide for themselves what is the best avenue for them.”

He added: “Looking ahead to next year, we see how events on the other side of the globe have impacted gas prices and our subsequent price cap predictions. In the same way as we saw wholesale market volatility impact our cap forecasts last year, similar developments risk causing sharp changes in household bills in 2024.

“The UK’s structural reliance on gas imports means that it is highly susceptible to fluctuations in the international wholesale energy market. This situation continues to highlight the need for an energy policy that can accommodate the practicalities of a global energy market with support for domestically sourced, sustainable supplies which can help bring stable energy prices for all households.”

There have been recent calls to do away with the price cap altogether, due to fears it is unintentionally forcing consumers to pay higher bills.

Early this month the Centre for Policy Studies (CPS) released a report which found that, due to the energy crisis, all tariffs have been priced at or just below the price cap for almost two years. In become a “de facto regulated market price” the price cap has, rather than protecting consumers as was its intended purpose, is eliminating market competition thus, forcing customers to pay more for their energy bills.