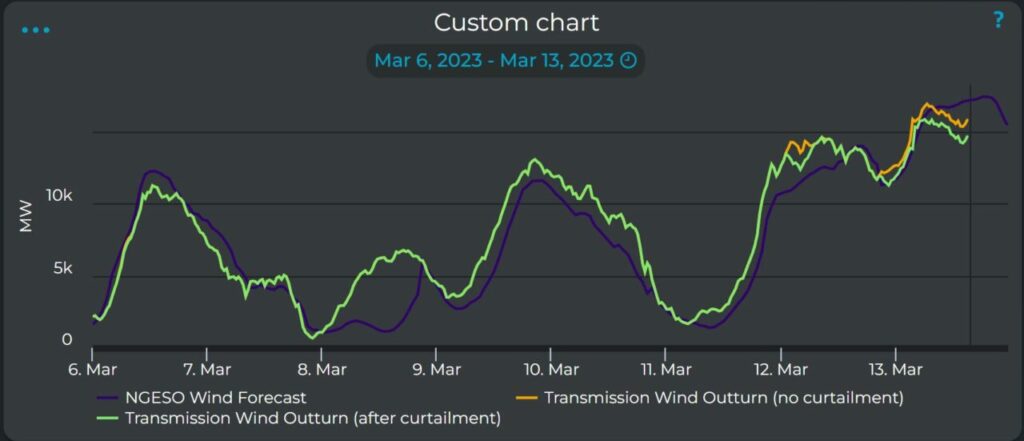

Amid low winds, cold weather and French strikes, National Grid ESO used its contingency coal units for the first time last week, as the imbalance prices surging to £1,950/MWh.

“The gas crisis has pushed our energy system to evolve, accelerating the buildout of British renewables and ever-growing pipeline of smart battery storage so we’re not reliant on costly imports from abroad,” said Jess Ralston, head of energy at ECIU in response to the use of the coal unites.

“Coal is still set to be phased out next year, and more and more technologies, like the Demand Flexibility Service, are allowing the public to save money and do their bit in the move from our outdated energy system to a modern, smart one.”

In this weeks’ Current± Price Watch – powered by Enact – we take a look at the use of the coal units, the surge in imbalance price and how National Grid ESO worked to keep the lights on.

Day Ahead: Dynamic services jump into action during weekend frequency event

Day Ahead prices were notably stable in comparison to other metrics over the last week, hitting a high of £192/MWh on 7 March and a low of £23.4/MWh this morning (13 March).

Saturday 11 March saw National Grid ESO’s suite of Dynamic services jump into action following a frequency event at around 13:30.

This use of its suite of ancillary services follows last week’s mock auction of the new Static Firm Frequency Response service (SFFR) – discussed in the last edition of Current± Price Watch – which National Grid ESO will use to secure its dynamic or non-dynamic response to changes in frequency in the future.

In September that it is indefinitely postponing the phaseout of its Dynamic and Static FFR systems, which Dynamic Containment, Dynamic Regulation and Dynamic Moderation are set to take over from. At the time, it set out a new consultation on both Dynamic and SFFR, following which it hopes to continue to procure the services beyond March 2023.

Intraday: ESO issues first EMN of the winter

APX Mid prices hit a high of £580.38/MWh for last week on Tuesday 7 March, and a low of £ -2.96/MWh this morning.

To help manage tight capacity on Tuesday, the ESO issued its first electricity margin notice (EMN) of 2023.

This is driven by the cold weather being experienced across Britain, which contributed to peak demand being forecast to surge to its 10th highest level of the winter, at 45.3GW at 18:00.

Additionally, planned strike action in France over pension reform at EDF limited interconnector capacity.

The ESO reported a shortfall of 980MW, which falls below the current contingency requirement of 700MW for the period 16:30 to 20:30.

“An electricity margin notice (EMN) has been issued to the market. This is a routine tool that we use most winters, and means we are asking generators to make available any additional generation capacity they may have. The EMN does not mean electricity supply is at risk,” said the ESO in a statement.

Around 15:30, the ESO cancelled the EMN, having secured sufficient capacity for the evening peak.

Following on from the high prices last week, surging wind generation today has led to prices dipping into minus figures, as well as the carbon from the grid being markedly low.

Imbalance: Contingency coal units put to use for the first time

On Tuesday, the imbalance price surged to £1,950/MWh over the evening peak as tight capacity led National Grid ESO to take enhanced actions.

This included the EMN – as discussed above – but also the first use this winter of the contingency coal units.

“Two coal units at West Burton power station have been turned on this afternoon (7th March 2023) to provide power ahead of a potentially tight evening on the GB electricity system. This is the first time that National Grid ESO has had to call on its Coal contingency contracts that were put in place last year to extend the life of coal fired power plants this winter and provide additional security of supply. These contracts are only intended to be used when all commercial options have been exhausted by National Grid,” said Shivam Malhotra, consultant at LCP Delta on Tuesday.

“With insufficient spare capacity on the system forecast between 16.30 – 20.30 today, National Grid ESO had instructed coal fired units at Drax and West Burton at 03.00 on 7th March to be prepared to provide additional power if required. That power is now needed, and coal fired power from the two units at West Burton has started generating electricity from coal and will be producing for the next 10 hours. Concern on the tightness of the system has been triggered by strikes in France which is reducing confidence in securing electricity from the interconnectors, along with low wind output in GB, and forecast high demand at 18:00 tonight.”

National Grid ESO has warmed its contingency coal units four times this winter, on 7 February, 26 January, 23 January and 12 December, but this was the first time the units were actually put to use.

National Grid ESO has partially been able to avoid using the coal assets by reducing energy demand through its new Demand Flexibility Service (DFS).

Octopus Energy has argued that going forwards, services like this could completely replace the need for coal as a source of back-up power.

“Household flexibility is a far more efficient – and readily available – solution to managing system peaks than warming up coal plants. National Grid’s new flexibility service has proven – households are a massive untapped source for reliable flexibility,” said Alex Schoch, head of Flexibility at Octopus Energy.

“This winter British homes turned down 300MW of electricity when the grid needed it most, enough to displace an entire coal unit. If other energy suppliers delivered the same amount of flexibility that Octopus’ 600,000 participating customers provided, we wouldn’t have to keep one foot in the past by keeping coal units on standby.

“Consumer flexibility is ready today and should form the basis of balancing strategy in a future power system.”

The tight capacity the coal units helped meet last week led to the highest imbalance prices seen this year, but they remained less than half of the record high set in 2021, of £4,037.80/MWh.

To find out more about LCP Delta’s Enact platform, click here or follow them on Twitter or LinkedIn for the latest market updates.