Research group Cornwall Insight has said that Third Party Charges (TPCs) could lead to small and medium enterprises (SMEs) in North Wales and Merseyside paying nearly £19,000 more in electricity bills on average compared to their counterparts in London.

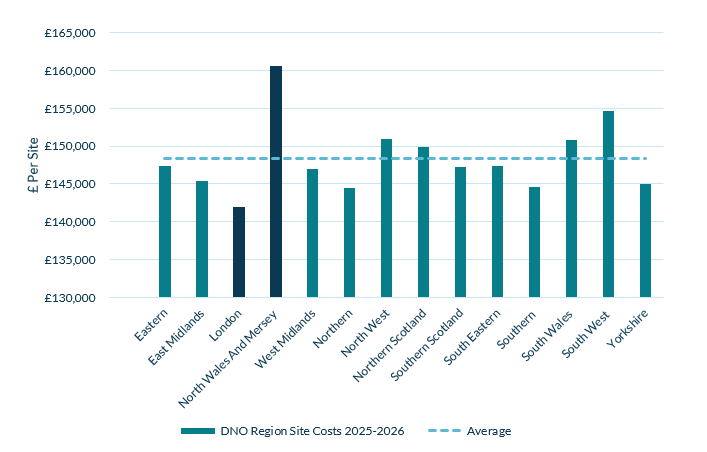

According to the group’s Business Energy Cost Forecast, a professional services business or a medium-sized office will incur £161,000 annually in electricity costs, making it the highest in the country.

Their costs are approximately 8% higher than the national average of £148,000 per year and 13% higher than the average in the capital at £142,000 per year. Cornwall Insight said that higher non-wholesale costs – also known as TPCs – will be one of the key reasons for this disparity.

TPCs are costs beyond raw energy and supplier costs, covering infrastructure maintenance, security, and development. Around 60% of energy bills include TPCs, which are often split into network charges like distribution and transmission costs and policy costs for government-led initiatives like renewable energy.

Given these disparities, the research group anticipates that many businesses will have their electricity contracts up for renewal in April. As a result, numerous companies are likely to seek supplier changes in hopes of securing better deals amidst high costs.

TPCs contributing towards regional disparity in electricity bills

TPCs differ from region to region, with the regional variance almost exclusively down to the level and structure of network charges between the areas. These are set for each of the 14 regions of the British electricity market by regulated price control for each of the Distribution Network Operators (DNOs).

As noted by Cornwall Insight, although zonal pricing continues to be a hot topic in the UK, the market also has a regional disparity in terms of electricity bills. Zonal pricing would see costs dictated by local generation and demand: high generation and low demand would see lower electricity costs localised to the area. Fragmenting the market in this way would better reflect grid constraints.

Zonal pricing has various supporters in the UK, such as Octopus Energy, but questions on its suitability for the country continue to mount.

The CEO of the UK’s energy regulator Ofgem, Jonathan Brearley, has spoken favourably in the past about a shift to zonal pricing on a podcast episode. Although this does not necessarily indicate the regulator’s view, Brearley argued it is not “credible” to leave the market as it is.

Commenting on the research, Dr Craig Lowrey, principal consultant at Cornwall Insight, emphasised the need for SMEs to remain educated and informed on their energy options.

“With many contracts up for renewal in April, now is the time for businesses to review their energy strategies, explore switching opportunities, and consider efficiency measures to help ease rising costs,” Dr Lowrey said.

“Understanding the makeup of energy bills and engaging proactively with the market could be key to managing these financial pressures. With the government looking at the prospect of regional wholesale electricity costs as part of its market reform programme, it is clear that a holistic view of the energy costs faced by businesses is needed.”