Data from research consultancy firm Cornwall Insight suggests that electricity bills for large retail and leisure units and small manufacturers are set to reach £200,000 higher in 2026 than pre-crisis costs.

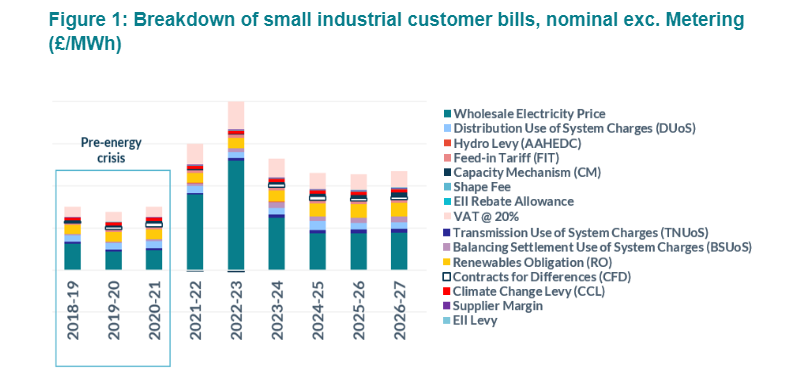

This will see small industrial businesses paying £238/MWh, equating an average total of £550,000 annually assuming an average yearly electricity demand of 2.33GWh, by the contract year April 2026 – March 2027 (2.33GWh is the research firm’s consumer archetype figure).

Compared to pre-2021 gas price crisis levels, this is a 57% increase in costs, which sat around £350,000 annually or £151/MWh.

Currently, bills sit around £232/MWh, £540,000 annually on average. Cornwall Insight’s Business Energy Cost Forecast, which aligns with the typical April to March contract renewal period for most businesses, shows that this is a decrease on the highs seen in 2022-2023, when bills hit nearly £1 million a year.

Changes coming in over the next couple of years, including the rise in newer carbon levies and the anticipated introduction of new cost elements, are expected to see prices increase from April 2026. Similar trends exist across SME and large industrial customers.

Unlike households, which are also being hit by high energy bills, there is not a price cap for businesses, exposing them to the full cost of the electricity market. While focus on domestic renewable energy generation will filter through to bills, Cornwall Insight says that it may take several years before this benefit is felt, due to the lead time associated with investment in new projects.

Dr Craig Lowrey, principal consultant at Cornwall Insight, called business energy bills “the energy elephant in the room”.

He said: “Many businesses, especially in the retail arena, are navigating an increasingly challenging environment, with some struggling to survive month to month. Our forecasts showing energy costs are going to rise in 2026, only add to the pressures faced by businesses.

“We hope the renewed focus on delivering sustainable domestic production can bring some stability to the energy market and lower bills in the long run. However, as we await these potential cost reductions, it’s essential that policymakers and industry leaders work together to find solutions that can help alleviate the burden on businesses, many of whom cannot afford to wait years for relief.”

Distributed energy for lower bills

The report comes shortly after Cornwall Insight forecast a very slight drop in the energy price cap for residential consumers to come in January 2025. The firm’s analysis suggested that a combination of the EU meeting its gas storage targets, strong global supplies of liquid natural gas (LNG), and improved market confidence has caused wholesale market prices to fall slightly.

Of course, as mentioned above, wholesale prices are not the only factor impacting energy costs for businesses. Still, decoupling, even slightly, from the wider energy market can be a way to improve operational costs.

For example, distributed energy might be one way businesses can cut their energy costs without waiting for nationwide changes to rollout. As AMPYR Distributed Energy’s CEO, John Behan, explored in a Current± blog, distributed energy helps to reduce energy costs (in some cases by up to 50%). It also means lower carbon emissions and supports business resilience by reducing reliance on a centralised energy supply.

A Centrica Business Solutions survey revealed that 56% of UK businesses intend to increase their onsite generation capacity in the next two years, although most of these cited the cost of energy above environmental benefits as their motivation.