Joe Hennessy, market analyst for PV Tech Research, provides an overview of European green hydrogen projects—how much has been built so far and what is in the pipeline for the coming years.

Green hydrogen has been the subject of increased interest within Europe recently, in particular driven by incentives from the European Commission.

The analysis and graphics are taken directly from the latest release of PV Tech Research’s Green Hydrogen – Global Completed Assets & Pipeline Database.

More than 60 projects currently under construction

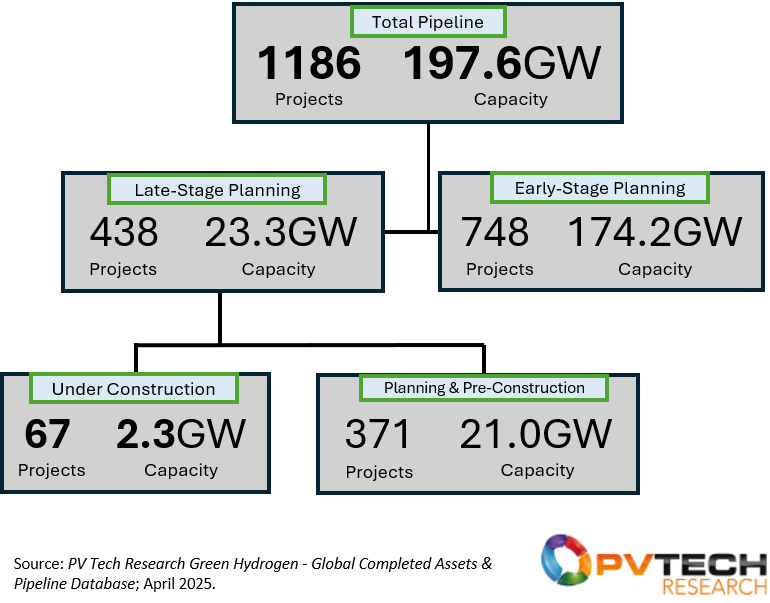

The pipeline for green hydrogen projects in Europe is, as expected, heavily weighted to early-stage developments. Figure 1 (below) outlines the overall pipeline, split across different build out phase categories: early stage, late stage and under construction.

The average size of the projects across the three categories is as follows: 233MW for early-stage projects; 56MW for late stage; and 36MW for under construction.

Since green hydrogen activity started in Europe, the average size of the projects has been increasing. However, the early-stage category is somewhat heavily influenced by a few very large projects, not planned to be built until the late 2030s. A number of these large projects are looking at offshore wind as the possible power source, or to be co-located with solar and battery storage.

Early-stage projects are typically at the ‘feasibility’ stage (or even earlier from a scoping perspective). If they do end up moving to completion, they may be operational in 5-10 years at best.

Late-stage planning includes projects moving towards ready-to-build status and includes those close to starting construction; depending on the size, these projects could be operational within the next three to five years.

The leading countries today in Europe are Spain (mostly from the low cost solar and storage battery availability), Germany (mainly from wind and solar, and having a ready supply of industrial off-takers), and the Nordic regions (with some areas here having an almost ‘fully renewable’ grid, based mainly on hydroelectric and wind power).

RWE’s Lingen project a key part of Europe’s 2025 growth

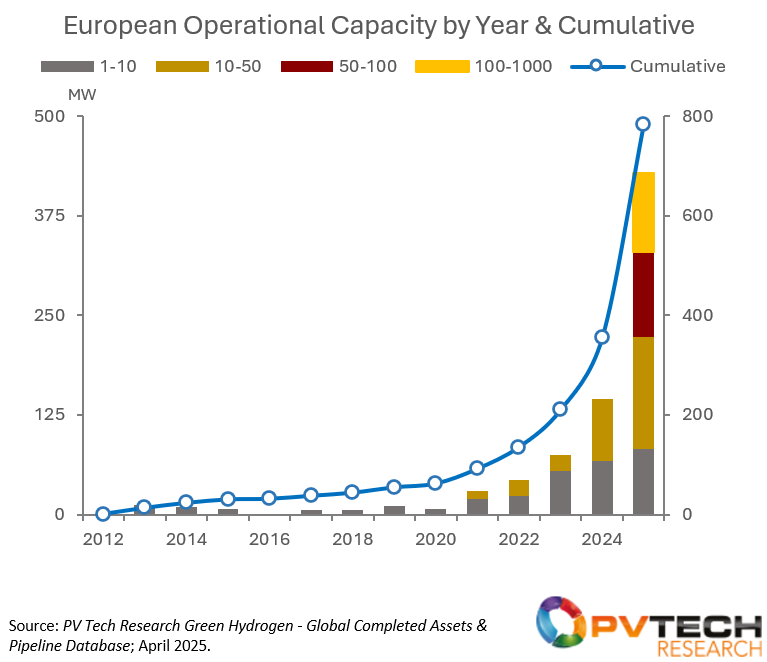

Figure 2 shows the annual green hydrogen capacity additions in Europe from 2012 to 2024, with a forecast for 2025. Annual capacity is split into different project size categories.

Almost half of the 2025 capacity forecast comes from just three large projects: RWE’s 100MW GET H2 Nukleus site in Lingen, scheduled for completion by the end of the year; European Energy’s 52.5MW Kasso e-methanol plant, which is in the final commissioning process; and BASF’s 54MW Ludwigshafen project, which has already been commissioned.

One key difference between 2024 and 2025 relates to the size of the projects installed. Thirty-five projects were completed in 2024, while just 44 projects are forecast for 2025.

The increase in average project size (between 2024 and 2025) can be attributed in part to government funding schemes, in particular the Important Projects of Common European Interest (IPCEI).

Technologies dominated by alkaline electrolysis and proton exchange membrane

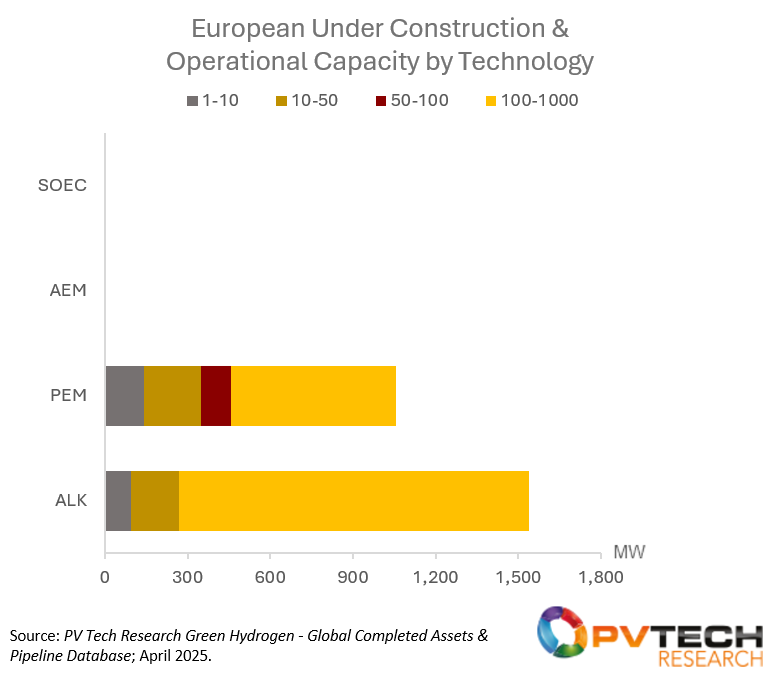

Until now, the largest sites in Europe have tended to use alkaline electrolysers, likely because of lower costs.

Thyssenkrupp Nucera is currently supplying the largest site under construction in Europe – the 740MW H2 Green Steel project. HydrogenPro supplied 100MW of its electrolysers to Salzgitter for a low carbon steel site that should move into production at the end of 2026.

Other equipment companies active now in Europe include: Sunfire, supplying the 100MW third phase of RWE’s Lingen plant and a P2X Solutions project in Finland that has just become operational; John Cockerill, a company with more projects outside of Europe but has supplied a 25MW project in Belgium; and Nel, one of the few companies that offers both PEM and alkaline electrolysers.

Looking at Figure 3, PEM has a larger market share across the smaller sites. It is worth pointing out that the development of PEM electrolysers has greater traction in Europe today, compared to, for example, China or other places in Asia.

Siemens is supplying the largest site PEM in Europe under construction: Air Liquide’s 200MW Normand’Hy project. Also, ITM Power has supplied to three 100MW sites, all in Germany; the first two phases of the Lingen site and Shell’s Refhyne 2. US-based Plug Power has supplied a 100MW site in Sines, Portugal.

Finally, the other two technologies shown in the figure above are anion exchange membrane (AEM) and solid oxide electrolysis cells (SOEC).

AEM has the potential to be a low-cost, low-temperature option. The technology has similarities to PEM but uses a transition metal instead of the rare metals, platinum and iridium. The main proponent in Europe for this technology is Enapter, these electrolysers will be supplied some of the so-called ‘hydrogen valley’ projects in Italy.

SOEC is a high temperature electrolysis cell, possibly less plug-and-play than the other technologies, but with the potential for higher efficiencies. European grants to develop this technology have been awarded to the likes of thyssenkrupp nucera, Elcogen and Topsoe.

PV Tech Research’s Green Hydrogen – Global Completed Assets & Pipeline Database contains the full audit-trails of global Green Hydrogen projects above 1MW in size.